Business owners’ top three risks in Canada are cyber incidents (35%), the skilled workforce shortage (33%) and climate change (29%) – differing from last year when business interruption, cyber incidents, and climate change were deemed the top 3. We’ve been talking about the current “Hard Insurance Market” environment for the longest running ...

According to a new report by TÜV SÜD Global Risk Consultants, inflation has led to insurance coverage gaps and disaster resilience problems for many companies. These coverage gaps arise due to losses from natural disasters – such as hurricanes and wildfires – resulting in claims that do not cover rebuilding or replacement costs. The report f...

Navigating the benefits landscape has been a complex process for companies over the last twelve months, as they balance the need of keeping expenses under control with the necessity of producing attractive packages to remain competitive in the current job market. Despite massive layoffs in tech and other industries at the start of 2020, the ...

According to recent reports, the auto insurance sector in Canada may experience a shift in 2023; however, this shift is likely to be represented by an increase in premiums. Expert analysis of the Canadian auto insurance sector in 2023 shows that insurers entering the new year must not only adjust their premiums to keep up with inflation, but also n...

Over the last few years, business interruption has been a major issue in risk management. The worldwide spread of COVID-19 and the ensuing lockdowns and travel limitations had a significant consequence on many businesses, causing huge losses. In 2022, before the world had completely recovered from the pandemic, business interruption was back in the...

A recent whitepaper from a consulting firm has reported that delays in collision repair services, which began in 2021 and are still persisting in 2022, are unlikely to end in the foreseeable future due to a continuing shortage of repair technicians in Canada and the United States. The Romans Group LLC reported that since the start of the pan...

Will Ferrell Hubbard Insurance Group Insurance Dream

The Canadian property & casualty (P&C) insurance market remains in what is termed a ‘hard market’ environment, challenging for us and clients alike. In fact, in over 30 years in the business, I’ve have never seen a market cycle like it.Rate momentum in many sectors seems to be stabilizing, some capacity re-entering the market, and the insur...

In the space of two years, most offices went from 100% in-person work to 100% remote; but now many offices exist in some middle ground between the two. With hybrid work being a fairly new model to most workplaces, there’s still some ambiguity around how to best work with this new mixed set-up. Hassan Osman manages virtual teams for a living ...

Those who have their fingers on the insurance pulse will know that the insurance industry as a whole has been locked in a hard market for quite some time – something we have discussed before. However, within the insurance industry, it must be said that the case of the Transportation Insurance industry is particularly fascinating. According t...

With ever increasing M&A activity across many sectors, there is an insurance coverage that can take some of the risk associated with acquiring a target company. Inaccuracies in representations and warranties made by the seller or the target company in connection with a merger or acquisition can result in costly liabilities. Buyers can be left w...

Cyber insurance is a bit of a catch all and covers cybercrime such as social engineering, ransomware (extortion), electronic compromise, breaches, phishing schemes and the like. It is without a doubt the single biggest claim area for insurance, and in the first half of 2021 we have seen more cyber claims then in the past 5 years combine...

The concept seems a strange one. Why would cyber criminals go after transport? The usual suspects when it comes to cybercrime tend to be financial institutions – such as the recent hacks on Desjardins and Capital One. The answer, though, is rather simple. Cyber criminals go wherever there is technology. If that technology can be exploited in a boom...

According to a major study conducted by KPMG, as much as 84% of Canadians state that they will reconsider doing business with an organization that has suffered a data breach. To those who have kept their finger on the pulse, this comes as no surprise. As we have mentioned before, cybersecurity is becoming an essential part of any organization’s ins...

The world seems to simultaneously be both on fire and under water. There has been a spree of natural disasters all around the world – from the wildfires and floods in Europe and Asia in July to the wildfires and floods in Canada and America today. We have previously covered how climate change is worse than we all think – but what does this m...

There is no doubt that the pandemic has affected the working world significantly – with a rapid shift to working-from-home occurring as a direct result. A change of this magnitude, then, means that traditional benefits plans are no longer serving their purpose and must also change in kind. Here are some changes you can expect to see in an in...

The sun is shining its brightest best, grills across the country are being fired up, and normalcy is slowly making a return. In the words of the legendary Nina Simone, “I’m feelin’ good.’ Welcome to the final part of our Pride series. In previous iterations, we have covered the origins of the Pride Parade as well as the origin of the Pride flag its...

Welcome to part II of our Pride Month series! Last time around, we touched upon the origins of the Pride movement before moving onto a little profile of Karen Fuentes – a broker here at Hubbard. If you haven’t yet, make sure to check it out! It’s a Monday, the weather is doing its best Martin Riggs impression, and I’m making dated Lethal Wea...

As we mark the beginning of June and the imminent arrival of summer, it’s a good time to turn the spotlight onto what June has become increasingly known for – Pride. Now, Pride Month is more than just a celebration of lifestyles; in fact, it has a rather dark past. June 28, 1969. 1:20 A.M. Four plainclothes policemen wearing dark suit...

With the ever changing landscape of insurance, it can be crucial to identify trends before they reach the mainstream – and, at Hubbard Insurance Group (HIG), we regularly bring out the proverbial crystal ball to make some predictions. With that said, here are 6 trends that we think will play a major role in 2021. Virtual Care Is Here For Good...

The concept of depreciation is pretty straightforward – most things, with time, decrease in their value. This is something that is perhaps most prevalent with cars; in fact, it could be argued that the second-hand auto industry is entirely reliant on depreciation in order to provide more affordable vehicles to those operating under stricter budgets...

Directors and Officers continue to play an integral role in the development of an organization. As these professionals are crucial parts of corporate governance and decision-making, it is imperative to make sure there is a safety-net in case mistakes are made – something we have discussed previously. The risk, though, is only rising. A global surve...

We are very pleased to announce the addition of Sana Subhani to the Hubbard Insurance Group as Group Benefits Specialist and Susan Jacques-Bennett as a Commercial Insurance Advisor, effective April 19, 2021! Sana has many years experience working as a Benefits Specialist… most recently with one of the Group MGA insurance leaders. Susan has experien...

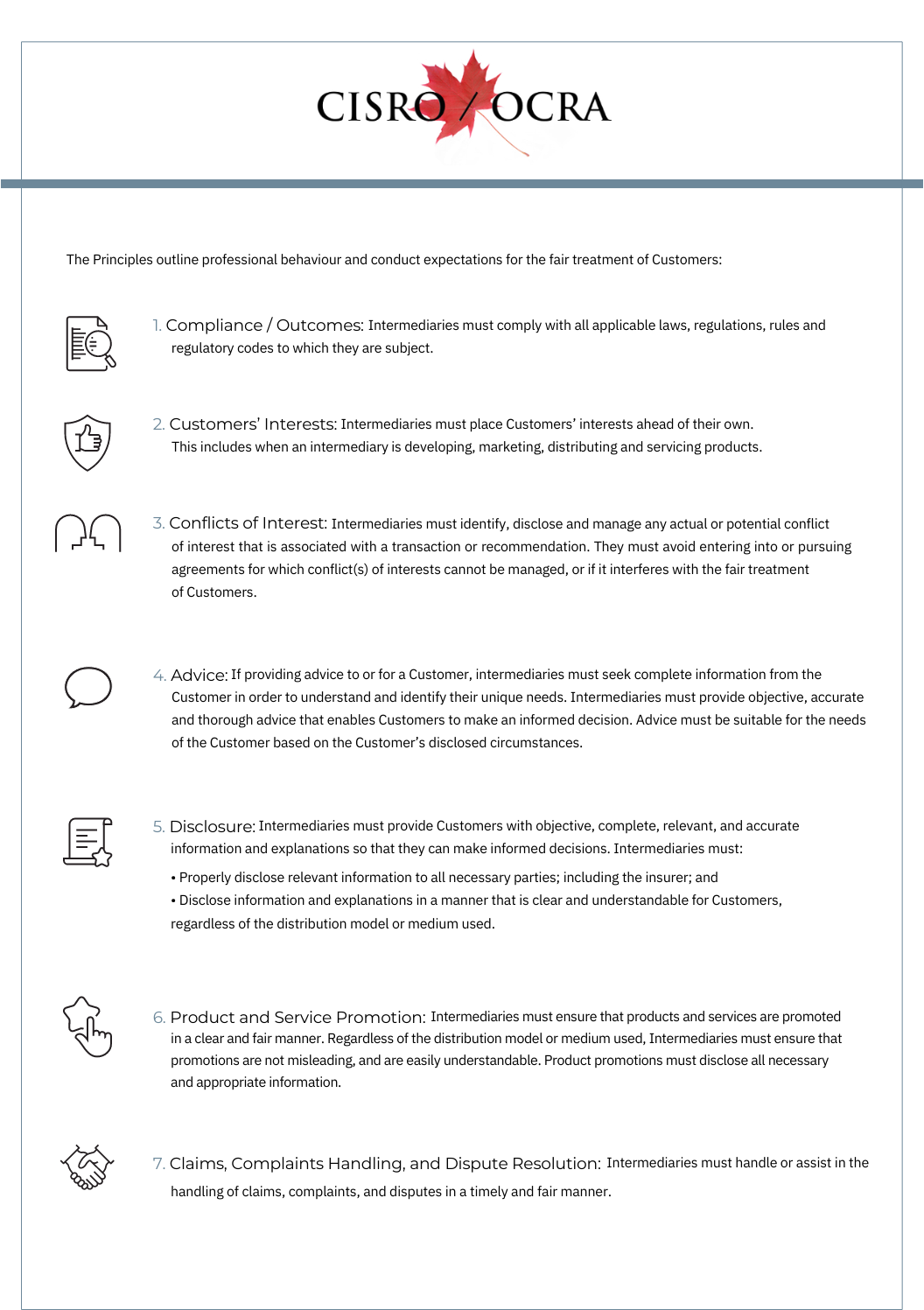

Thank you for your business. As your Independent Insurance Broker, we purchase insurance products and services on your behalf that are available, affordable, and understandable. Our role is to provide you with the best insurance value that combines coverage, service, and price. We also provide personalized, quality service that includes professiona...

At the start of 2020, there were a few murmurs on social media about a novel coronavirus that was beginning to cause concern. By March of the same year, the lives of all Canadians would change forever. In the time since, there has been a major shift in the routines of the working force – and the consequences of this shift are becoming increasingly ...

We have some exciting news! On the ‘team happenings front’, we wanted to let you know that Nancy Mills is now recognized as our office’s Senior Commercial Insurance Advisor. With over 25 years in the industry, Nancy has been managing some of the largest and most complicated risks in our office. Although Nancy’s quick to say that it seems like every...

If you have your finger even remotely on the pulse, you will know that one of the major trends in 2020 going into 2021 was how data breaches were going to affect directors’ and officers’ liability claims. According to a new report by Allianz Global Corporate & Specialty (AGCS), “outside the U.S., securities class actions are being filed in reco...

Did you know that the average individual loses over $4,000 to cyber criminals? With the ever-growing presence of technology in modern society, more people are at risk of cyber crime than ever before. Hackers look to the vulnerable, unprotected sections of the population and attempt to steal sensitive data such as social insurance numbers as well as...

It is no secret that the impacts of the coronavirus are far-reaching and have been devastating for many. Not only have the effects been felt physically, but data suggests that there has been a major increase in claims for medications that treat mental health issues; particularly depression and anxiety. In fact, according to Express Scripts Canada, ...

No matter what happens around us – be it a global pandemic or the apocalypse itself – you can be sure that there will be a group of people looking to take advantage of you. Covid-19 has been no different. Though the Canadian Centre for Cyber Security states that they have taken down an abundance of fake government websites, emails, and notification...

We are very pleased to announce the addition of Jodi Clarke to the Hubbard Insurance Group team in the position of Operations Manager. Jodi has developed extensive management experience, people leading, project planning and brings organizational skills to the table that will help her in the duties of supporting the already strong and dedicated team...

Though November has been a historically warm month so far, Ontario has seen its first proper snowfall of the year. The Canadian winter is nefarious for many reasons – one of them being how much more difficult it can be to drive in snowy, icy conditions. With that said, whether you are a seasoned driver or someone who is about to drive through winte...

If it seems like weather forecasts are becoming decreasingly accurate and increasingly speculative – well, that’s because they are. Experts use present-day climate models to predict how severe the weather will be in the future; except those predictions are becoming inaccurate because of the destabilisation of weather that has been observed across t...

If you have your finger even remotely on the pulse, then one thing is clear to you – we are living in an increasingly digitized, cyber world. In this world, there are obvious dangers; and these dangers apply universally. When discussing the threat of a cyber-attack, often times the subject of cost comes up. Is it worth it to have cyber protection? ...

We are very excited to announce the addition of Amanda McCormack to our Commercial Insurance Advisor Team this week!! Amanda comes to us with a vast background in client advocacy in the commercial insurance and risk management space, with significant experience in the specialized Transportation Insurance sector. Amanda will be working with new and ...

As schools begin to open up all over the country, some institutions have tried to find ways to mitigate their risks regarding Covid-19. According to Lyle Adriano of Insurance Business Canada, “While private schools could issue waivers to students’ parents to allow children to continue attending classes amid the COVID-19 pandemic, legal experts warn...

With the country slowly returning back to normal, schools are beginning to open up; however, this news isn’t welcomed by all sections of the population. Parents who fear for the safety of their kids in schools have decided to set up “Pandemic Pods” – environments to homeschool small groups of children. The issue is, though, that this is not safe. I...

We recently brought to light the introduction of virtual care into the mainstream of the healthcare world. While that piece served as more of a summary for those unfamiliar with virtual care, it is now time to go more in-depth. The International Foundation of Employee Benefits Plans recently conducted a survey and the findings were quite spectacula...

As the country continues to follow the path of opening back up, some of us have started to adjust back into some of our old responsibilities and activities. With some of our customers possibly heading back to work or establishing a ‘new normal’ for themselves and their families, we wanted to reach out to remind you that if you have made changes to ...

Call Toll Free

Call Toll Free